Happy Sunday! The LA 2028 Summer Olympics will make history as the first Games ever to sell naming rights for its venues to sponsors — continuing the long-standing American tradition of branded stadium names. Today we're looking at the factors driving one of Las Vegas' worst summers in years and whether investors and CEOs think tariffs are a "boiling frog" process for inflation. |

Have feedback for us? Just hit reply - we'd love to hear from you! |

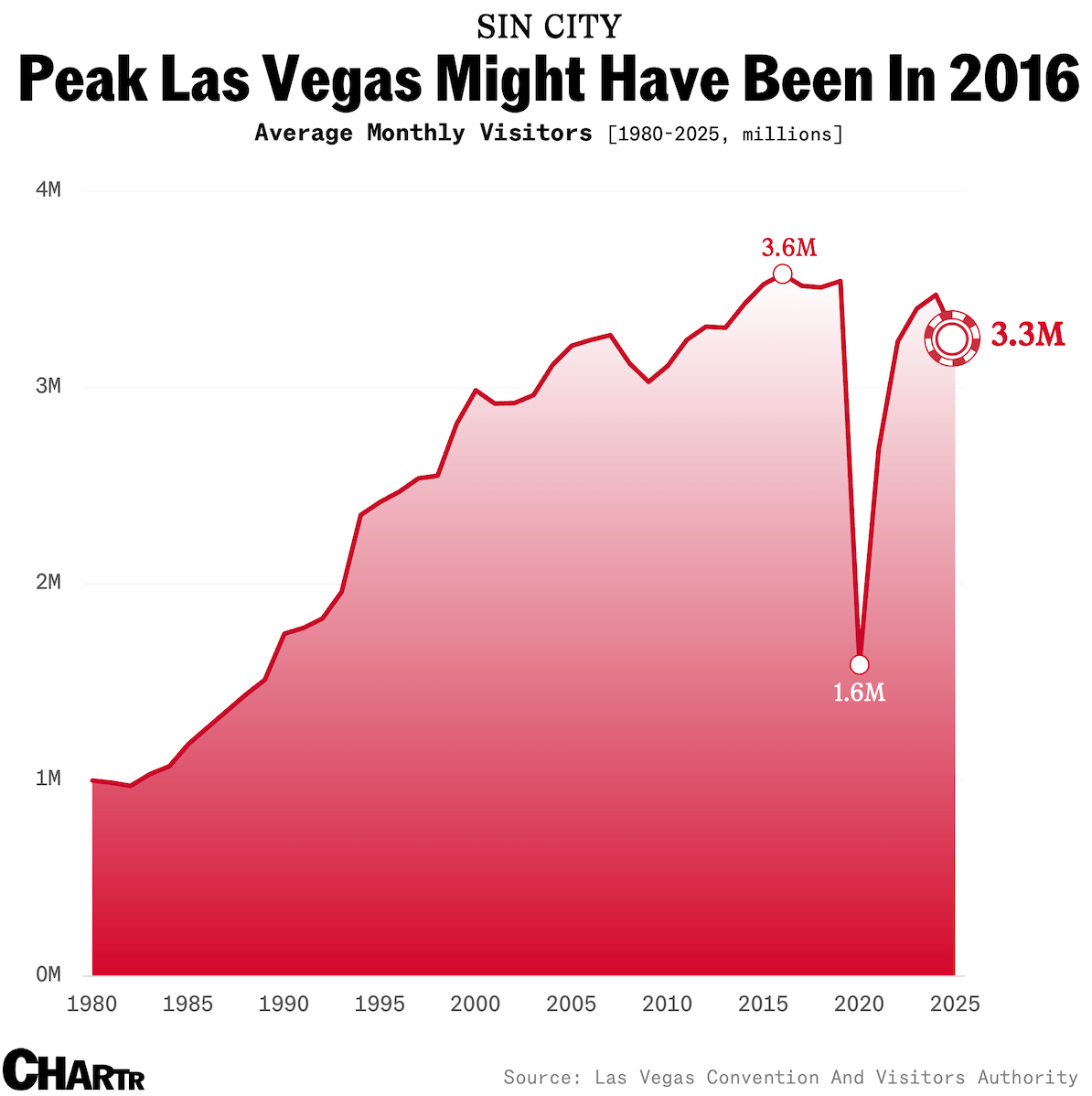

The click-clacking of the roulette tables; the dings, chimes, beeps, and whistles of the slot machines; and the general hum of America's gambling capital should be reaching fever pitch about now. But this year, Sin City is a little quieter than usual. According to data from the Las Vegas Convention and Visitors Authority, the number of visitors to the city has dropped every single month in 2025, relative to 2024, with June seeing 11% fewer tourists than the same month last year. Hotel occupancy rates are down, and passenger numbers through the city's Harry Reid International Airport have also fallen 4% so far this year. |

Historically a barometer for how frivolous Middle America is feeling, Las Vegas' woes are out of step with many other signals from the economy. Even during some of the worst financial conditions, like the global financial crisis, the yearly drop in visitors was not as sharp as it has been this year (down 6%). Put simply: in modern times, Vegas has never seen this level of slowdown, with the exception of the pandemic. So, what explains Sin City's slump? Some people think it's simply become too expensive, with exorbitant fees for everything from parking to food. Maybe higher prices are figuring in people's decision to veer away from Vegas this year, but there's certainly another major factor, too: Americans' growing ability to make wild bets while sitting on their couch. |

|

|

Other great stories from the week |

|

|

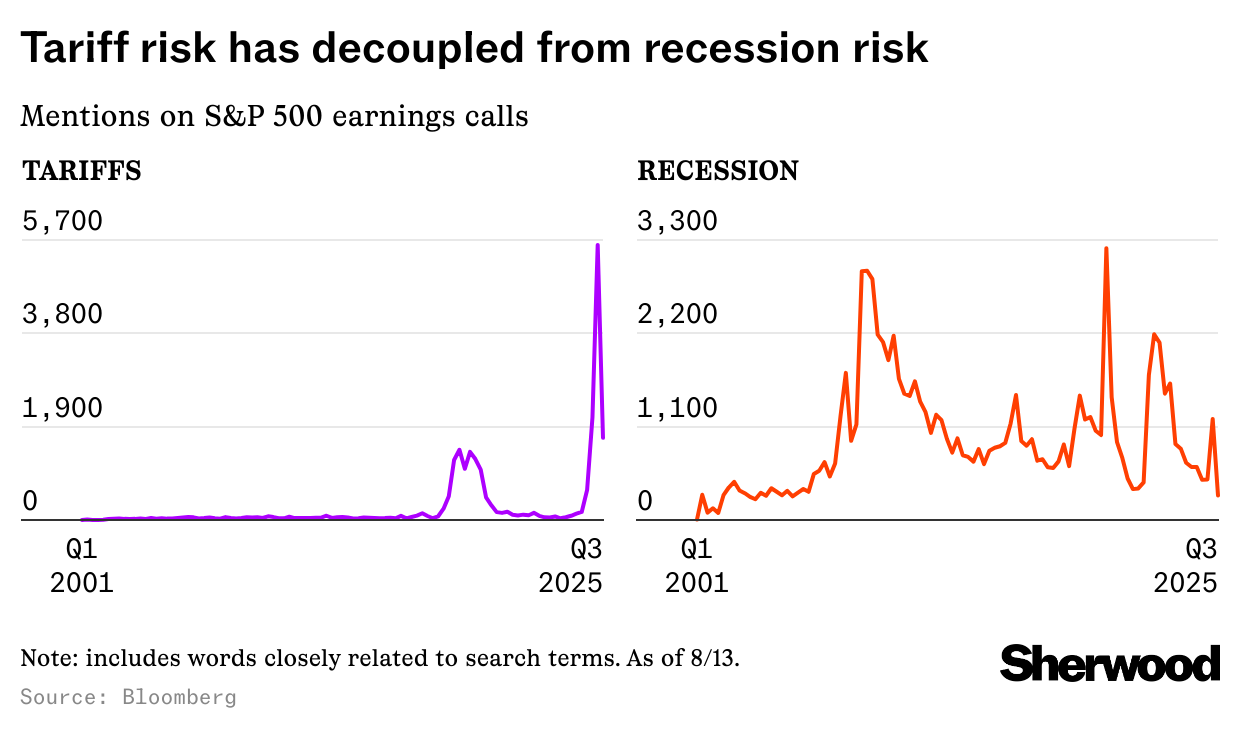

There's no doubt execs and analysts are still talking a lot about tariffs, but something major has shifted — and it's part of the reason why stock markets in the US and globally have been so buoyant. Indeed, mentions of "recession" and related terms in S&P 500 companies' quarterly earnings calls have fallen to their lowest level since 2005, and the odds of a recession have also dropped precipitously on event contracts platforms. |

The number of references to tariffs, on the other hand, remains extremely high. A Bank of America survey of fund managers also showed that while a trade war triggering a global recession remains the biggest tail risk, with 29% deeming it as such, that share is down substantially from 80% in its April survey — despite expectations for the average US tariff rate rising steadily from 12% in June to 15% this month. So, what gives? Are tariffs a "boiling frog" process... or is the water really just lukewarm? Go deeper: Investors and CEOs have completely ditched the idea that tariffs will cause a recession |

|

|

Not a subscriber? Sign up for free below. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment