Hi! An 8.8-magnitude earthquake, the strongest quake since 2011, struck Russia earlier today — get live updates here on the subsequent tsunami waves hitting Hawaii, Japan, and the US West Coast. Today we're exploring: |

- Apple in China: A tale of shutting stores, sliding sales, and shrinking production.

- Oh, Novo: The value of Europe's former biggest company halved since last summer.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

Apple is doing something it's never done before: Shutting a store in China |

When Apple opened its first China branch in Beijing in July 2008, iPhones hadn't even officially launched in the nation, but people had reportedly started smuggling them in anyway. Now, just over 17 years later, Tim Cook's company is shutting a store in China for the first time in history as the country's appetite for all things Apple continues to wane. In a statement on Tuesday, the tech giant explained that its decision to close a branch at the Parkland Mall in the northeastern city of Dalian was based on other retailers moving out of the space, with locals reporting that Armani and Michael Kors have axed stores there. However, coming on the back of six straight quarters of declining sales in the region, the August shuttering reflects a clear picture: Apple is struggling in China. |

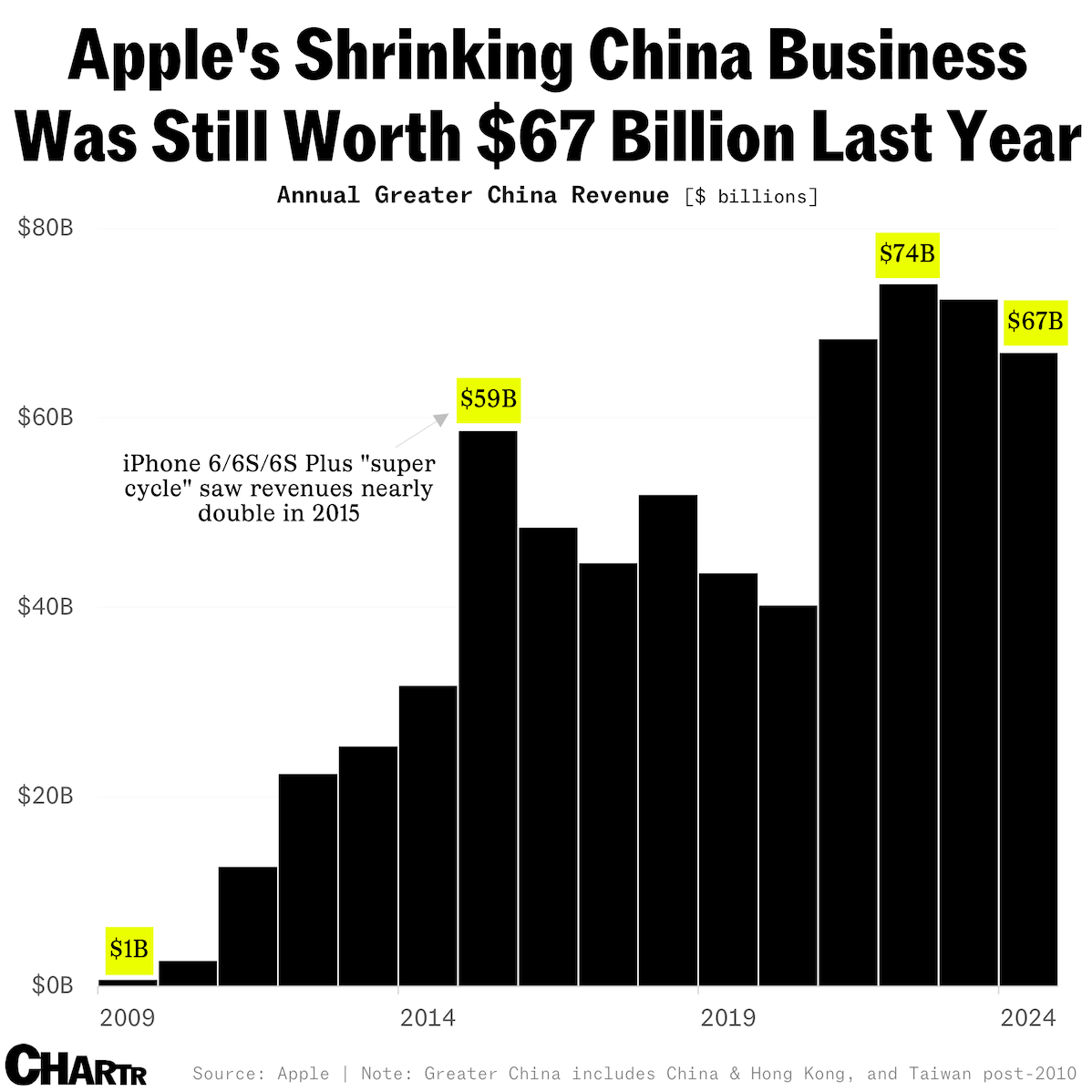

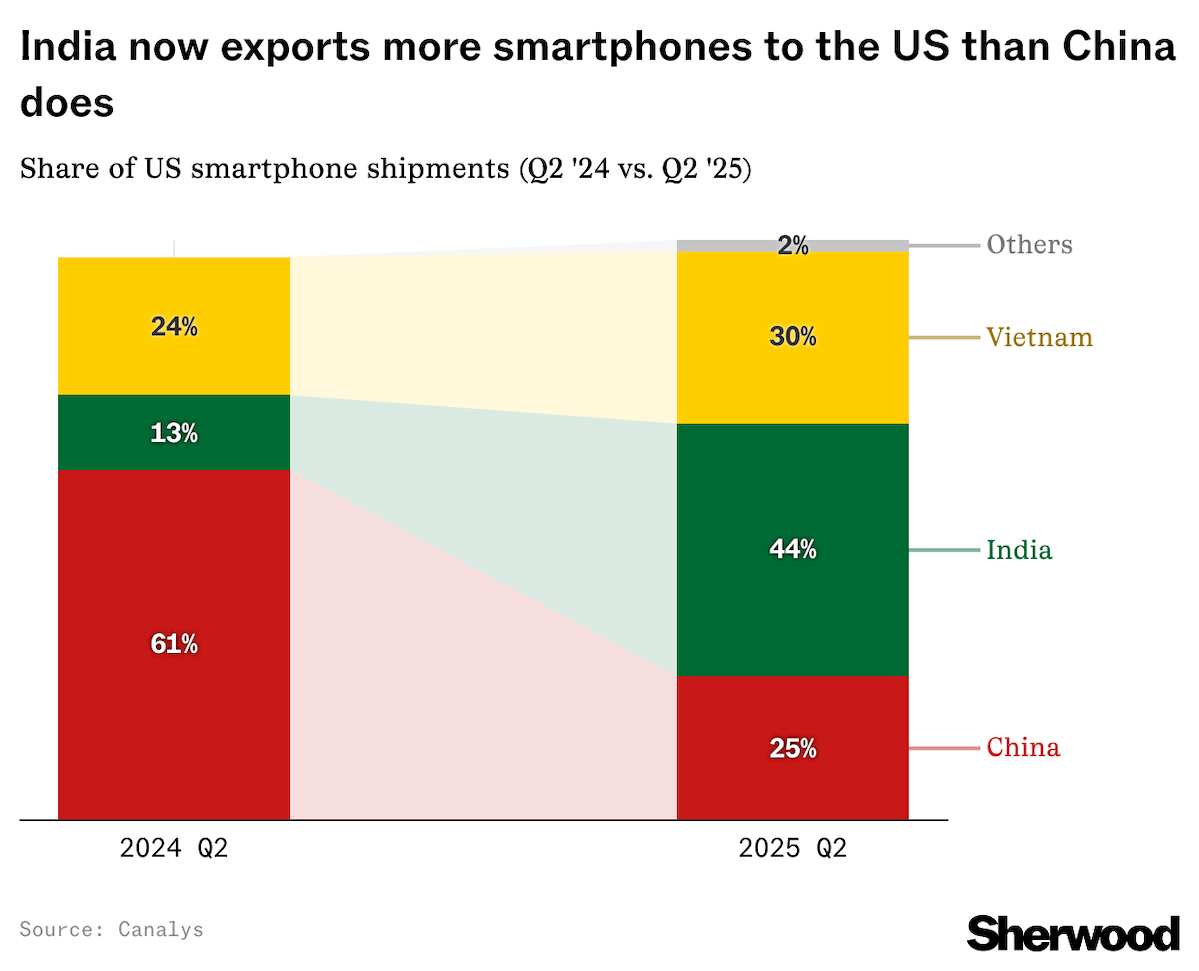

Last year, Apple's sales in Greater China slumped to $66.95 billion. While it's a little odd to talk of any company's sales in a single region "slumping" to that level — it's still about $20 billion more than Coca-Cola or Nike pulled in over the last fiscal year all told — Apple execs will be concerned that the figure's down 8% from the year before and almost 10% from its peak in 2022. But ironically, not only is Apple selling fewer iPhones in China, it's also making fewer of them there too. Indeed, US smartphones are entering their "made in India" era. According to new estimates from Canalys, India accounted for 44% of US smartphone imports in Q2, more than triple the 13% share a year ago — officially overtaking China as the top smartphone supplier to the US for the first time ever. |

China's share, meanwhile, more than halved over the same period, with the electronics powerhouse now making up just 25% of US-bound smartphones — even less than Vietnam. Put simply, Apple has been aggressively redirecting production out of China after the country faced a cumulative 145% tariff rate in April. In the company's latest earnings call, CEO Tim Cook said that the "majority" of iPhones sold in the US would be manufactured in India in Q2. What's interesting is that, for now, this is mostly a US-specific shift for the iPhone maker, as China remains the powerhouse of Apple's global smartphone production, particularly for devices sold outside the US. Other players like Samsung and Motorola are also moving US-bound smartphone assembly to India, per Canalys, though at a slower pace. |

|

|

Invest in the companies protecting you from tomorrow's cyber threats |

|

|

What's eating Novo Nordisk? |

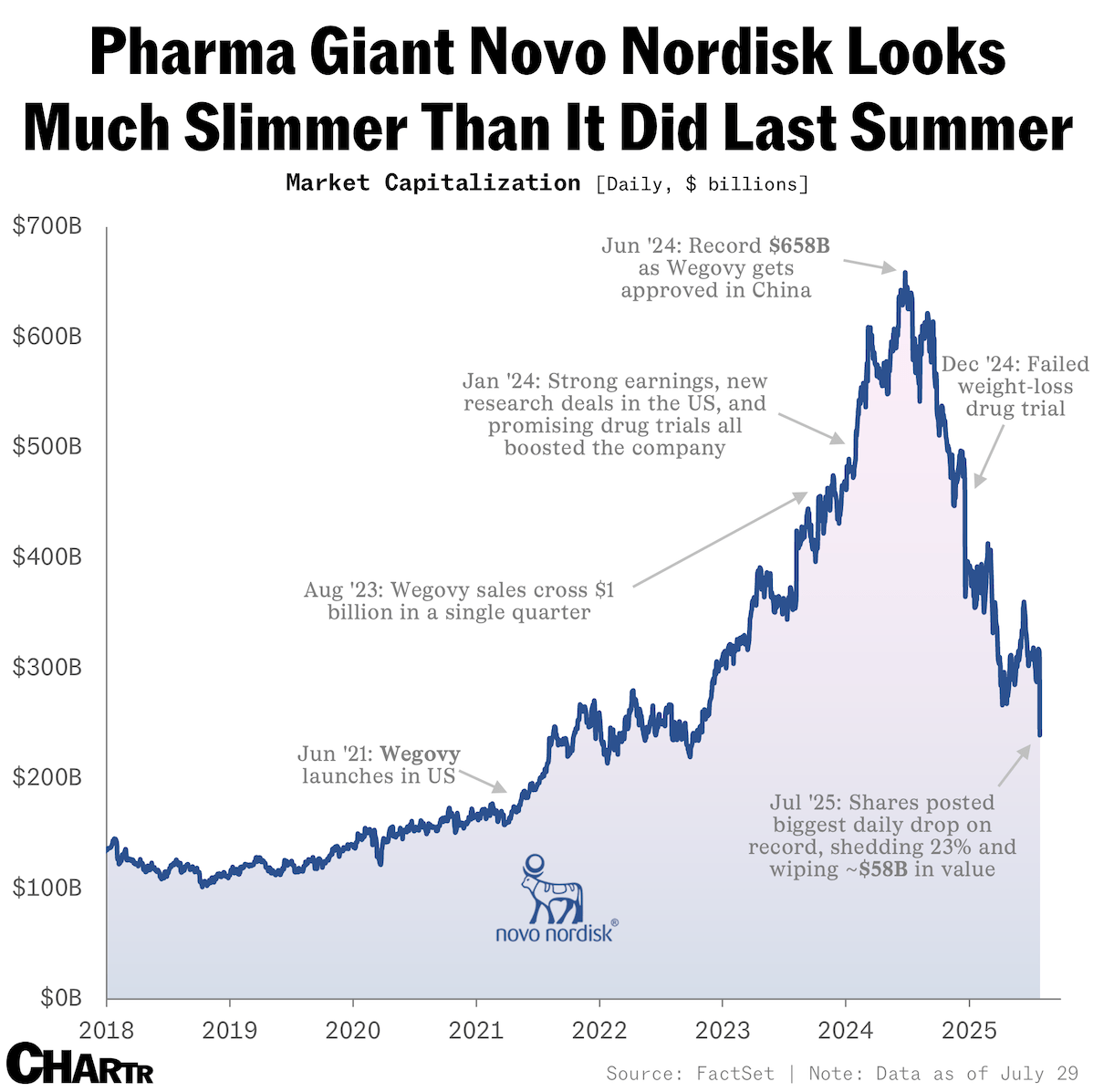

Last July, Novo Nordisk, the drugmaker that brought us Ozempic and Wegovy, was sitting pretty as Europe's most valuable company — and, with a margin of more than $200 billion between it and storied luxury house LVMH, it wasn't even really close. A lot can change in a year. |

Since peaking just shy of $660 billion last summer, Novo has been shedding market cap almost non-stop. Yesterday, shares ended up posting the steepest single-day drop in the Danish behemoth's history, sliding 23% after slashing its sales and profit outlook for the year ahead. Now, Novo's new CEO, a veteran insider who was announced around the slimmed-down outlook yesterday, will have his work cut out to stop the bleeding. |

If 2024 was the year that GLP-1s "took over," Ozempic (launched in the US in 2017) was very much leading the charge, having amassed enough cultural weight to serve as the poster-child for the new wave of obesity treatments. Since then, however, offerings from Eli Lilly, as well as stiff competition from compounders such as HIMS and Noom, have started to muscle in on Novo's leading Ozempic and Wegovy drugs. Notably, Lilly's Mounjaro and Zepbound have proven to be more effective for weight loss with fewer side effects, according to FT reporting. |

Much is made of first-mover advantage in business, but Novo might just be the latest in a long list of cautionary tales — Myspace, BlackBerry, Yahoo Search, Zoom, Peloton — that proves being early isn't always enough. With new GLP-1 effort CagriSema disappointing across trials in December and March, it's not just Novo that's feeling the pain; the company's slumping sales are hurting Denmark's national export figures, too. |

|

|

- Wingstop's strong second-quarter report had investors clucking for a piece this morning, with the stock up as much as 27% in early trading.

- PayPal will start letting US businesses accept payments from customers using over 100 cryptocurrencies "in the coming weeks."

- Revenue from Ray-Ban Meta smart glasses tripled over the past year, contributing to EssilorLuxottica's 7.3% year-over-year jump in H1 sales.

- Temping: Some 33% of new US CEOs started on an interim basis so far this year — up from 9% in the same period of 2024, according to data from Challenger, Gray & Christmas.

- TikTok is launching Footnotes, its take on X's crowdsourced Community Notes fact-checking system, in the US, with nearly 80,000 users signed up to chip in.

|

|

| - Older voters, younger presidents: YouGov charts on how Americans feel about voters under 18 and leaders over 79.

|

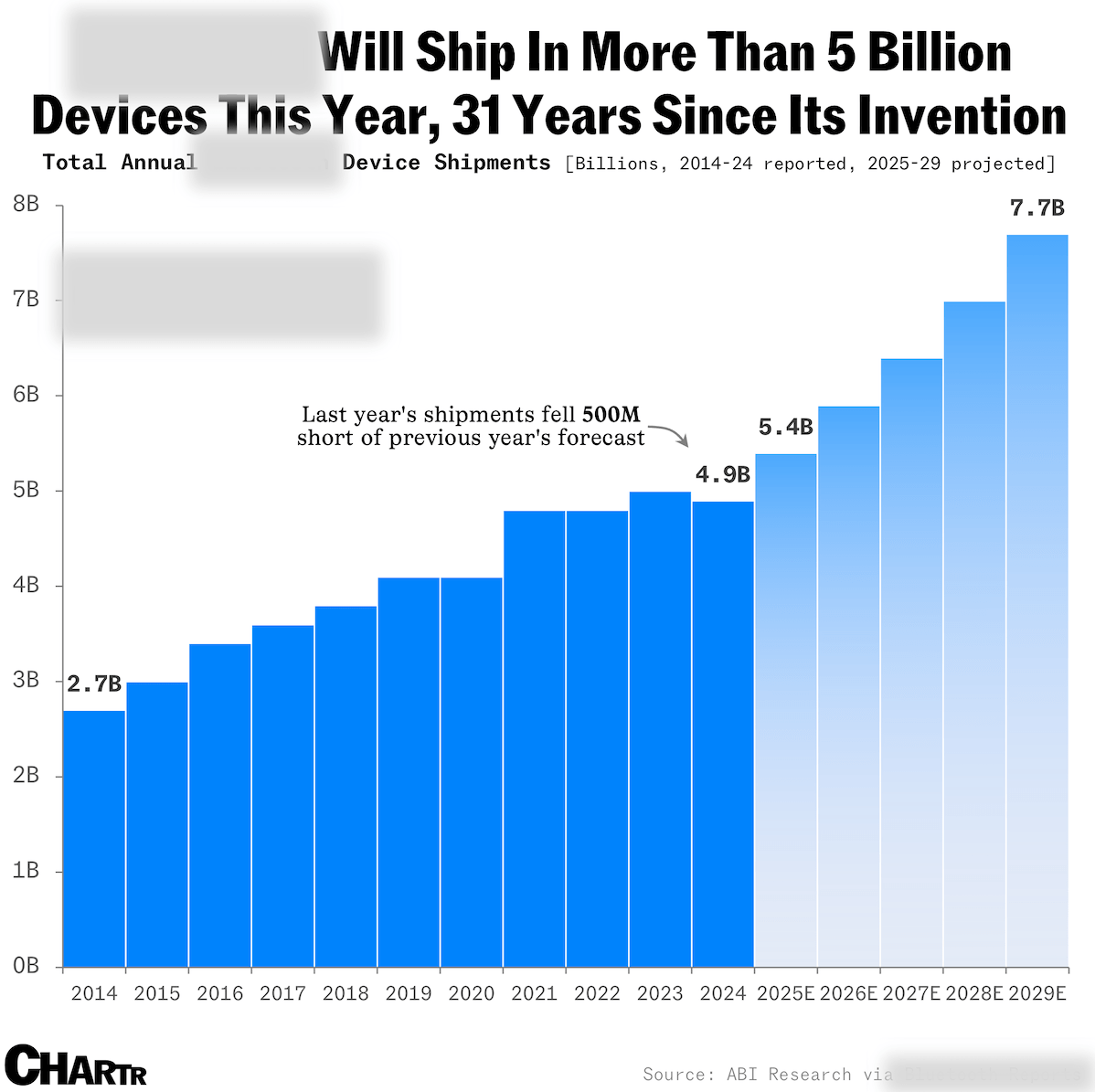

Off the charts: Twitter founder Jack Dorsey's new messaging app just hit the App Store — which decades-old technology, that's in tens of billions of devices, does the platform have at its heart? [Answer below]. |

Not a subscriber? Sign up for free below. |

Advertiser's disclosures: Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security, digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

| |

|

No comments:

Post a Comment