As we've flagged, tariffs, in the eyes of the stock market, are a solved problem. In the eyes of US executives, they're creating massive challenges. Case in point: after receiving a surprise tariff bill, the CEO of Keeley Electronics, a guitar pedal company, had to use an unconventional approach to foot the bill. Try to guess his method of payment. Was it: |

- 1.83 million American Express rewards points

- $14,304 in cash from liquidating four gold bars he'd purchased at Costco

- 66,271 dogecoin

- Four $3,750 payments via the buy now, pay later service Klarna

|

Check your answer. The S&P 500 dipped as traders ditched high-flying stocks and went bargain hunting. The start of the third quarter was marked by an intense rotation from the market's winners into value stocks. Alas, since value stocks often get that title from underperformance, making them smaller members of a benchmark, this shift in allocations saw the S&P 500 end 0.1% lower despite advancers outnumbering decliners by 255. Until today, the S&P 500 hadn't declined during a session in which this many of its constituents rose in all of 2025. The Nasdaq 100 fell 0.9%, while the Russell 2000 rose 0.9%. 🇺🇸 P.S. US stock markets close at 1 p.m. tomorrow, and on Friday, markets are closed for Independence Day, so we'll be back in your inbox on Monday. |

|

| Even if you don't work in the news business, you've probably heard the worries of journalists and digital creators everywhere that AI is slurping up all our hard work and giving us nothing in return — not money or even clicks that lead to money — as we see Google Search traffic fall off a cliff amid the rise of AI overviews. Yes, some companies paid to use material to train their AI, but many other models have been trained on pirated content. Well, possibly good news! An unlikely company, Cloudflare, is stepping in with a novel solution to this problem: "pay per crawl." Basically, Cloudflare is the content delivery wizard behind the internet curtain that ensures its customers' websites, images, and videos are accessible quickly around the world. That gives Cloudflare the unique ability to control who gets to see the content that it's distributing. While individual website owners can try to block AI bots from scraping their sites, Cloudflare can do it for billions of web pages at a time across 125 countries. The company says it serves about 20% of the web. Here's how pay per crawl works: |

- Cloudflare detects traffic that's from an AI crawler.

- Based on the publisher's choice, the AI bot can be allowed to access the site for free, it can pay to access the site, or it can be blocked altogether.

- If chosen, Cloudflare collects a micropayment from the AI bot, which it passes along to the publisher.

|

And voila! Sort of. There are a few hurdles to overcome before it gets out of private beta testing, but we're cautiously optimistic. |

|

| While the word "micropayments" initially sent up a red flag, unlike the many failed micropayment plans for content creators in the past, this one doesn't rely on individuals "tipping" or have the high transaction costs that made previous efforts unfeasible. Cloudflare will aggregate the charges and payments, making it more scalable, and the fact that it's already embedded in so much of the web means there's a lower barrier to adoption. That said, the scale and size of these payments is very much TBD. |

|

|

Nvidia, the center of the AI boom, is nearing a $4 trillion market cap, and most Wall Street analysts still think there's room for more upside. Except one. Jay Goldberg of Seaport Global Securities is not just the only analyst in the herd suggesting traders sell Nvidia, but has a price target of merely $100 — implying a roughly 35% downside to yesterday's closing price. His thesis is predicated on a few key pillars: |

- Nvidia is one of the leading beneficiaries of the AI spending boom, but its prospects are well understood and largely priced into the stock.

- Growing questions about how useful fAI actually is could lead to a slowing of budgets in 2026.

- Nvidia systems are more complex than traditional data centers and face potential challenges throughout the supply chain to deploy.

- Currently, Nvidia has a near monopoly position in the industry. But as Amazon and other tech giants build on efforts to make their own chips, Nvidia could lose key customers.

- In the nearer term, cyclical issues, including production limitations for its much sought-after Blackwell line, could raise further concerns.

|

|

|

While the largest contributor to Nvidia's bottom line is the one that gets the most press, let's not forget that Nvidia made $3.8 billion from its gaming division alone last quarter, which propelled it to an earnings beat despite a loss of $8 billion in potential revenue due to the ban of H20 exports to China. As for the future, reports indicate the company is working on an AI chip tailor-made for the Chinese market, and international demand for sovereign AI, which Nvidia is happy to help with, keeps growing as well. |

|

|

In the last 32 years of this sport, there's never been a collection of four such productive players who performed this well in the regular season, played together for so long, and achieved less. See our crushed hopes charted. |

|

|

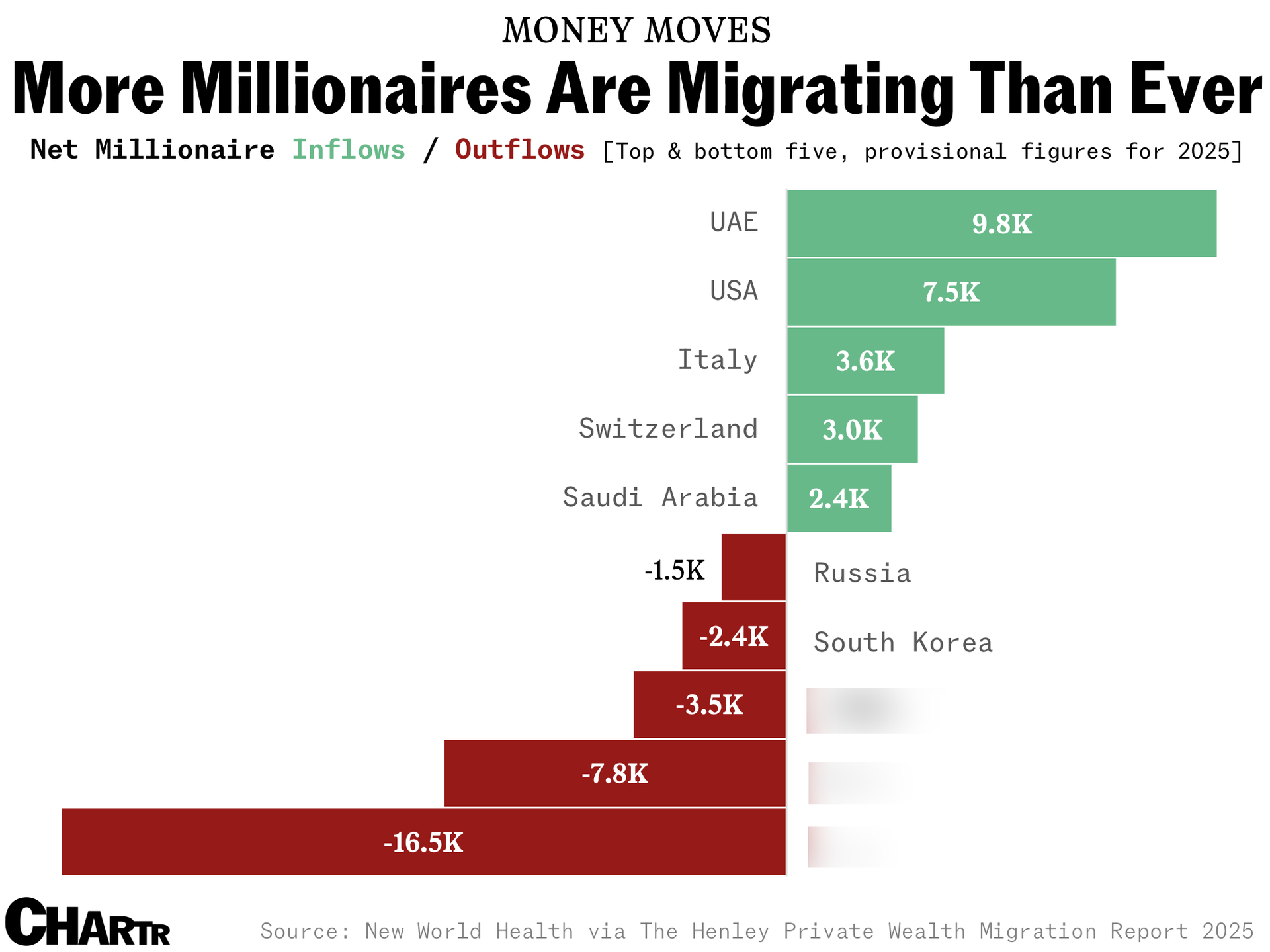

Which countries have the highest number of millionaires who are emigrating elsewhere? (Answer below.) |

|

| Yesterday's Big Daily Movers |

- Macau's gaming revenue surged in June, boosting Wynn, Las Vegas Sands, and Melco

- AMC tanked after finalizing a debt-for-equity swap and settling litigation with some of its creditors

- Wolfspeed surged over 100% as the embattled chipmaker files for bankruptcy, marking a major move to restructure its hefty debt load amid weakening demand

- Warner Bros. Discovery slumped after the Condé Nast family offloaded $1 billion in shares

|

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment