S&P 500 inches up, Nasdaq 100 gains to book record closing highs |

The S&P 500 traded in positive territory all day and managed to eke out another record close, though the advance was nothing to write home about. The Nasdaq 100 gained 0.3% to close at a record along with the benchmark US stock index, while the Russell 2000 sank 1.4%. Consumer discretionary was the worst-performing S&P 500 sector ETF, weighed down by Tesla, which fell 8% after CEO Elon Musk pondered the company's challenges on the Q2 earnings call (including developing full self-driving software as well as tariff and supply chain headwinds). In fact, energy, tech, and communications services were the only sector ETFs with a positive showing on the session. Gains were led by West Pharmaceutical, with shares up about 23% in its best day ever after the company, which makes tiny rubber components used for GLP-1 pens, crushed Wall Street estimates thanks to soaring weight-loss drug demand. LKQ Corp led declines, falling nearly 18% after the automotive scrapyard owner reported Q2 profits that fell short of Wall Street expectations and revised its full-year profit guidance lower. Elsewhere... |

- T-Mobile shares jumped about 6% as Wall Street digested the wireless giant's better-than-expected Q2 earnings results after-the-bell Wednesday, and a fresh upgrade to its full-year forecast.

- ServiceNow shares rose 4% after the cloud software company posted strong Q2 results and its CEO said the company would slow hiring for its "soul-crushing" roles.

- Chipotle shares tumbled 13% after the burrito biggie posted its second straight quarter of same-store sales declines, also missing the street's estimates.

- American Airlines' tumble neared double digits after slashing its full-year earnings outlook, projecting up to a $0.20 loss for the year — worse than the Street's expectations and its previous outlook.

- Southwest shares plunged 11% after posting disappointing Q2 results Wednesday and despite the airline's projections of earning over $350 million in bag fee revenue for the full year.

- IBM shares dropped nearly 8% after the company reported Q2 earnings that beat on the top and bottom lines, but posted weaker-than-expected growth in its important software division.

- Mattel shares sank over 16% after the toy maker posted mixed second-quarter results as demand picked up overseas, but wasn't enough to completely offset declines in North America.

|

- American Eagle shares rose 4%, finishing way off its premarket highs after a new campaign starring actress Sydney Sweeney sparked fresh retail buzz, landing the stock on r/WallStreetBets' trending list.

- UnitedHealth shares dipped almost 5% after the insurance giant said it was responding to requests from the Department of Justice regarding its Medicare Advantage business practices.

- Union Pacific and Norfolk Southern were down 4.5% and less than 1% respectively as the two rail giants admitted that they have, in fact, been involved in talks about combining their companies.

|

— Luke Kawa, Markets Editor & Nia Warfield, Markets Writer |

|

|

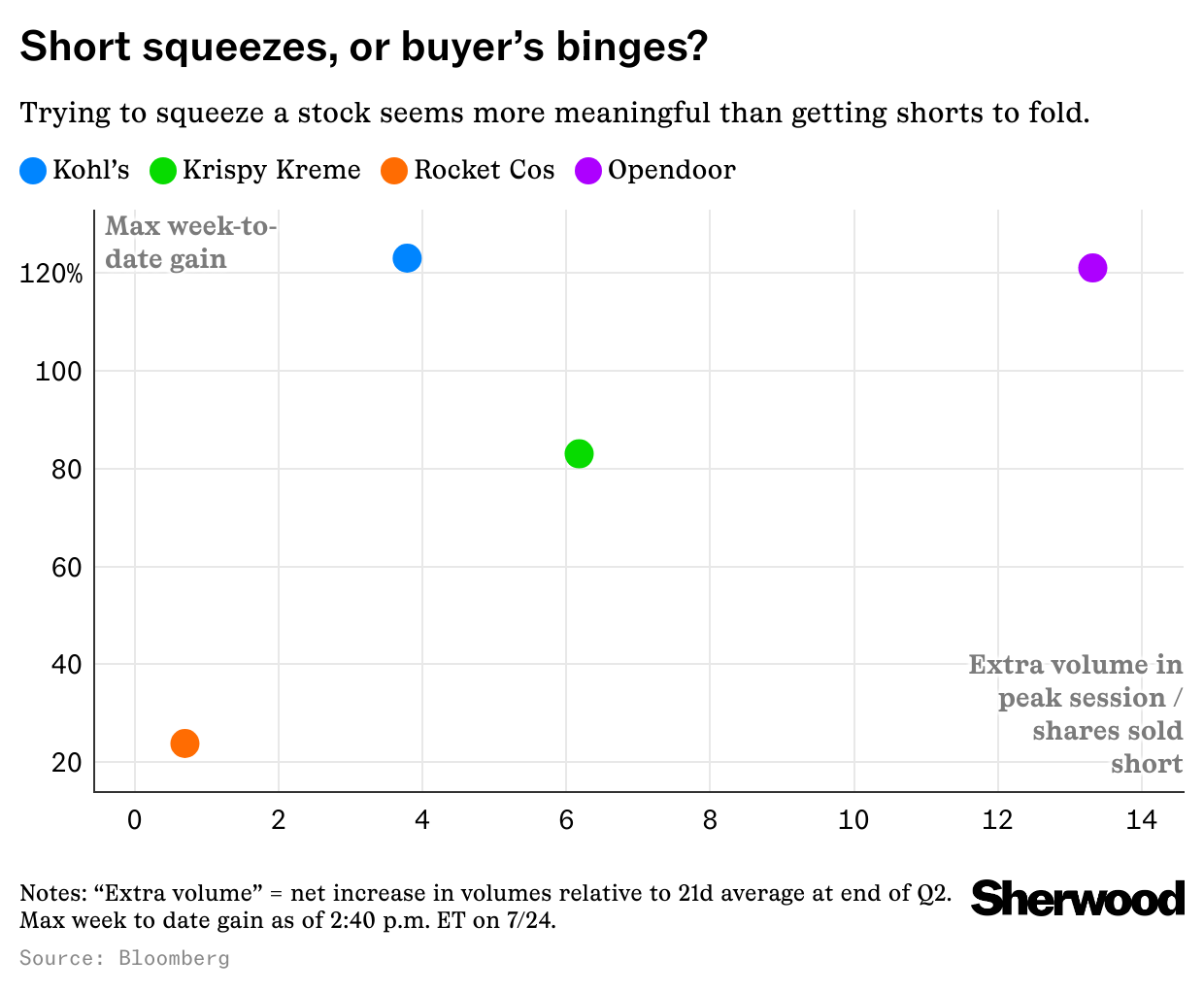

You're thinking about short squeezes all wrong |

The most important part of a "short squeeze" is the buyer's binge. Read more. |

|

|

Tesla's energy business has been juicing its top line for years — but now it's starting to slow down too |

Tesla's services business is the new bright spot, as the EV maker's energy division dropped 7% year on year. Read more. |

|

|

A stunning $3.1 billion in crypto has been lost just in the first half of 2025, from "smart-contract bugs, access-control oversights, rug pulls and scams due to phishing and social engineering," a new Hacken report found. Read more. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment