Microsoft, Meta earnings take sting out of the Fed Chair's warning on inflation risks |

The S&P 500 fell into the red and never made it back to positive territory after Fed Chair Jay Powell warned of more tariff-induced pressure on inflation to come, causing traders to price in lower odds of interest rate cuts. The benchmark US stock index fell 0.1%, the Nasdaq 100 gained 0.2%, and the Russell 2000 slumped 0.5%. However, the picture brightened materially in the after-hours session, with the SPDR S&P 500 ETF climbing out of the red and above its highs from regular trading hours after robust earnings from Meta and Microsoft. Humana rose more than 12% after the health insurance topped Q2 estimates and raised its full-year outlook. Big decliners included mining giant Freeport-McMoran, which tumbled after the Trump administration announced tariffs on imports of processed copper products, but excluded ore and cathodes. Elsewhere… |

- Wingstop shares soared 26% after the chicken chain posted better-than-expected Q2 sales and profit — and opened a record 129 net new stores last quarter.

- Peloton shares climbed 18% after UBS slapped a "buy" rating on the stock, citing recent subscription price hikes and early signs that user declines may be leveling off.

- Marvell Technology rose 7% after Morgan Stanley raised its price target to $80 from $73, while keeping its "equal weight" rating.

- Electronic Arts shares jumped 5.7% after Wedbush in a note said the Madden NFL parent company was set to outpace the rest of the video game market through its fiscal year 2027.

- Shares of Nvidia and Broadcom rose 2% and 1.7% respectively after Morgan Stanley raised his price targets on the chipmakers to $200 from $170 for Nvidia and to $338 from $270 for Broadcom.

- VF shares rallied 2.7% after the parent of Vans, Timberland, and The North Face reported a smaller-than-expected Q1 loss and showed early signs of a potential turnaround.

- Avis shares tanked 15% following a disappointing second-quarter earnings report. (Fun fact: renting a car costs about 40% more than it did a decade ago).

- Adidas shares sank 11%, after the shoemaker posted lower-than-expected sales in the second quarter and warned of the impacts of US tariffs in the second half of the year.

- Mondelez fell 6.6% after the Oreo parent beat Q2 expectations, but stuck with a muted full-year outlook as it faces historically high cocoa prices and slow demand in North America.

- SoFi Technologies dropped 2.3% after it announced plans to sell $1.5 billion of stock, giving up gains after the company topped Q2 and hiked its full-year revenue guidance on Tuesday.

|

— Luke Kawa, Markets Editor & Nia Warfield, Markets Writer |

|

|

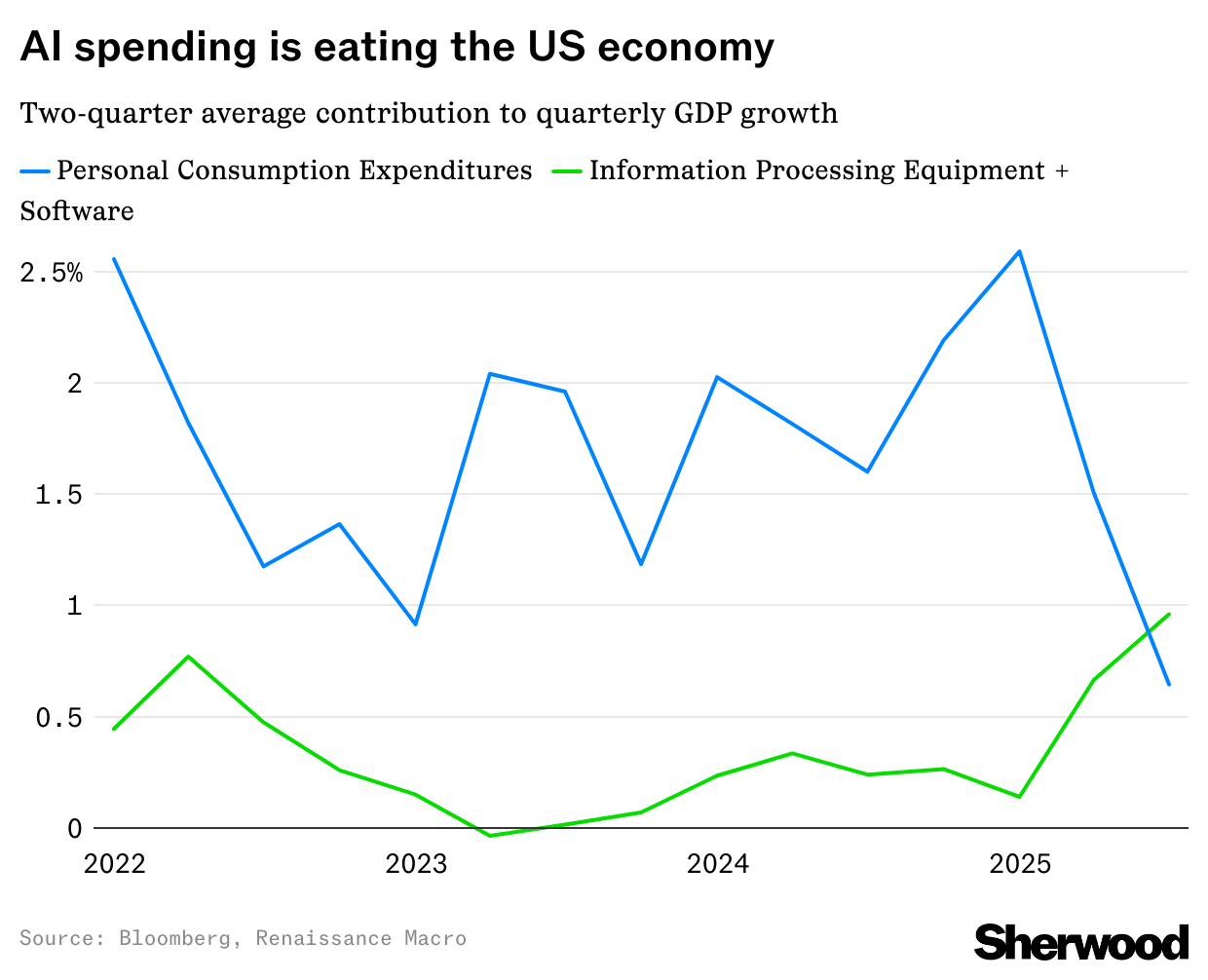

The AI spending boom is eating the US economy |

AI-linked spending has fueled more growth in the first half of 2025 on average than US consumer spending. Read more. |

|

|

What's eating Novo Nordisk? |

The Ozempic maker's market cap has more than halved since this time last year. Read more. |

|

|

- Ford slips as tariffs take an $800 million bite out of its earnings

Ford announced its second-quarter earnings results after the bell today. - AI startups' high-velocity valuations are shooting sky high

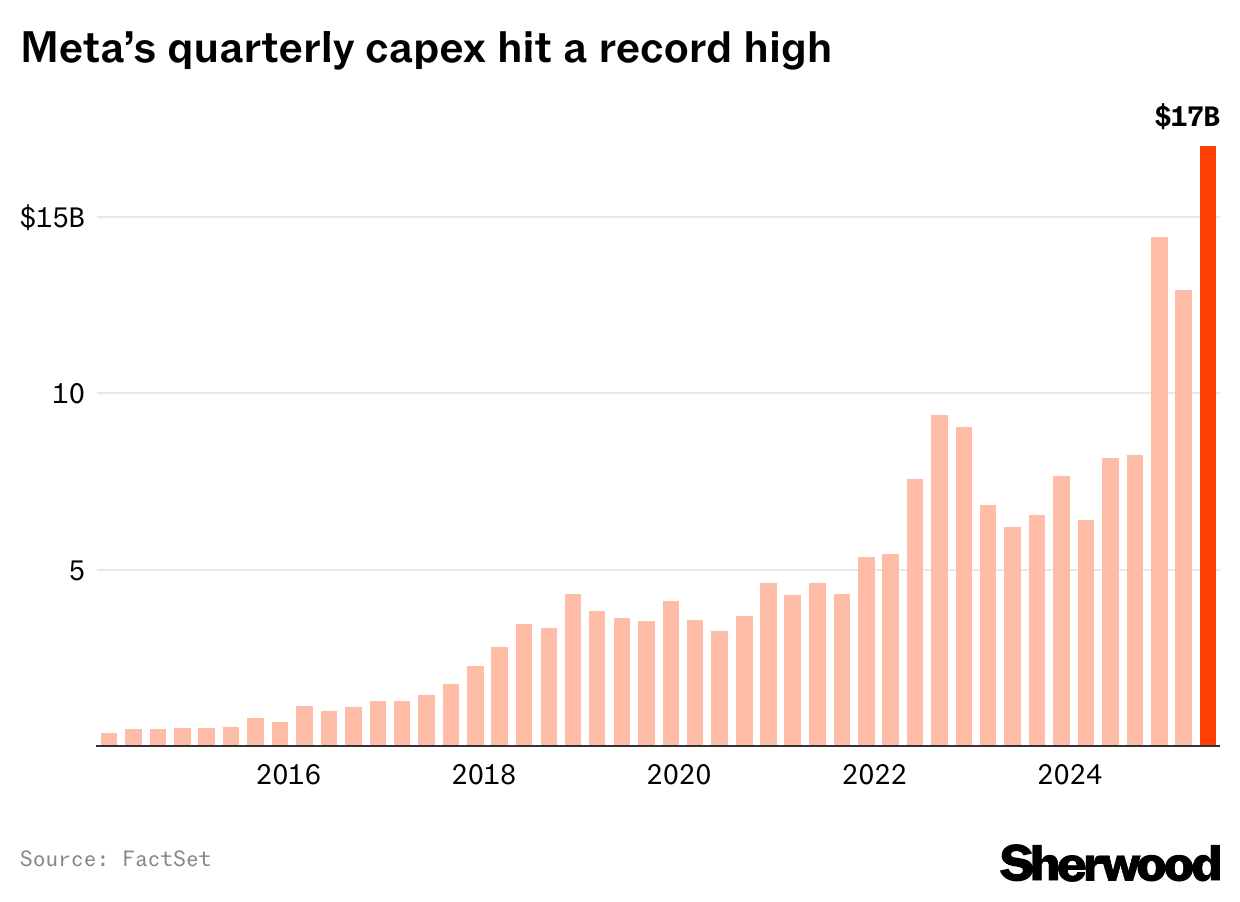

The race to invest in AI startups is pushing valuations to new heights. Anthropic is reportedly close to a fundraising round with a $170 billion valuation, just five months after a $61.5 billion valuation. - Meta CEO Zuckerberg posts manifesto about superintelligence

Meta: Personal devices like smart glasses will become our primary computing devices. - Carvana, still eyeing massive growth, climbs on earnings beat

The used car retailer announced its second-quarter earnings after the market close on Wednesday. - Pre-workout or pre-game? FDA recalls cans of High Noon that were mislabeled as Celsius

Celsius, the maker of the fizzy energy drinks, was flat on the news. - Biotechs rally on Vinay Prasad's exit from FDA

His departure comes after the FDA's back-and-forth on a gene therapy from Sarepta Therapeutics, which is up on the news. - Ives: Apple AI innovation "is not coming from inside the walls of Apple Park"

Ahead of Apple's earnings, the Wedbush analyst is again pushing the iPhone maker to buy Perplexity.

- White House's long-awaited digital assets report fails to boost bitcoin's price

Despite its length, it gave very few details on the bitcoin strategic reserve. - Zuckerberg to run AI team like a startup "unencumbered by the bureaucracy" of Meta

He's said he wants to run Meta more like a startup, but that the $1.8 billion company is just too big.

- Strategy acquires $2.46 billion in bitcoin, its largest buy since March

The company announced it acquired another 21,021 bitcoin. - Robinhood* reports strong Q2 numbers

The online brokerage increased net revenues and grew EPS.

|

*Robinhood Markets Inc. is the parent company of Sherwood Media, an independently operated media company subject to certain legal and regulatory restrictions. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment