Given the UK's extreme heat wave this summer, scientists have resorted to some unusual experiments, including smearing yogurt on windows, which researchers at Loughborough University discovered could actually cool temperatures. Yes, it will smell like yogurt, but apparently the scent dissipates after 30 seconds. Stocks opened at their highs of the day and spent the rest of the session in a slow grind lower, finishing near their lows. Markets briefly perked up when China said it had come to an agreement with the US to continue their trade truce, before the gentle slide lower resumed. The S&P 500 ended down 0.3%, the Nasdaq 100 gave back 0.2%, and the Russell 2000 underperformed with a 0.6% decline. |

|

|

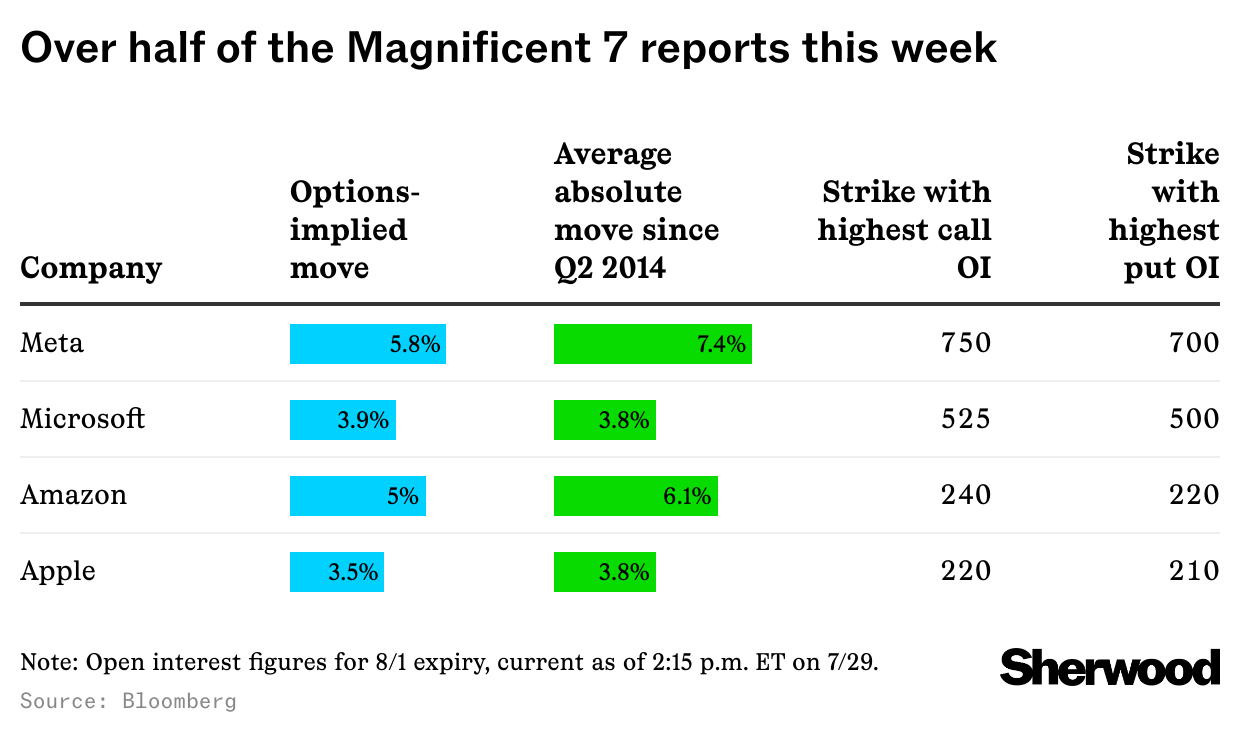

- Meta has tended to have the biggest post-earnings move of the bunch, averaging a swing of 7.4% over its quarterly earnings since Q2 2014. This quarter it also has the biggest range of options-implied movement of the group, with traders eyeing a 5.8% change.

- Apple and Microsoft, on the other hand, have tended to be the most stable after earnings, with each averaging an absolute move of 3.8% over the past 10 years. This go-round, Microsoft's expected to move within 3.9% after earnings, and Apple's expected to remain within 3.5%.

- In the middle is Amazon, which has an options-implied move of 5% and has averaged 6.1% over the past few years.

|

|

|

The information the market gets over the coming days is going to be incredibly useful for determining where the market goes from here. These four companies not only represent a big chunk of the value of the largest indexes in their own right, but there are also a lot of companies that sell things to them and a whole lot of companies that are their customers. |

|

|

Interest rates can impact all financial companies. Why continue to take single stock risk? |

The Financial Sector ETF (XLF) provides investors access to the financial stocks in the S&P 500, all encapsulated within a single security. Why continue to take on the risk of single stock exposure, when you can own the entire financial sector of the S&P 500? Learn more about the Select Sector SPDR Fund XLF. |

Advertiser's disclosures: All ETFs are subject to risk, including possible loss of principal. Sector ETF products are also subject to sector risk and non-diversification risk, which will result in greater price fluctuations than the overall market. An investor should consider investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus, which contains this and other information, call 1-866-SECTOR-ETF (866-732-8673) or visit www.sectorspdrs.com. Read the prospectus carefully before investing.

ALPS Portfolio Solutions Distributor, Inc., a registered broker-dealer, is distributor for the Select Sector SPDR Trust. |

|

|

It was 10 years ago today that the first block of ethereum was mined, also known as its "genesis" block. While some people mistakenly think ethereum was the second crypto created, it's really just second to bitcoin in market cap: it has nearly $460 billion to bitcoin's $2.3 trillion. In reality, there were many other cryptos that came between bitcoin's genesis block on January 3, 2009, and ethereum's in July 2015, but we don't hear a lot about peercoin, namecoin, or even litecoin — though you might recognize a little pup of a token called dogecoin, which based its protocol largely on litecoin's. Ethereum wasn't just going to be a currency: it aimed to be a censorship-resistant global computer not controlled by any single party. It introduced smart contracts to the crypto world and, for better or for worse, was the blockchain behind the NFT mania of the 2020s. It's been a big decade for ethereum, and its journey is a real catalog of crypto's biggest moments: from the ICO boom (and bust) to DeFi Summer, to the $69 million sale of Beeple's Everydays NFT, to ethereum's remarkable shift from proof-of-work to proof-of-stake (aka The Merge), to finally its entry into TradFi and ETFs, which managed to snare nearly $15 billion in their first year. |

|

|

For the first time ever, India has officially edged out China to become the top smartphone supplier to the US — and the shift in shipments year over year is dramatic, as our chart shows. China's share more than halved over the same period, with the electronics powerhouse now falling to third place to another Asian country. |

|

|

Yesterday's Big Daily Movers |

- Novo Nordisk, the drugmaker behind Ozempic and Wegovy, tumbled after cutting its annual sales and profit outlook

- Spotify fell after the audio streamer swung to a loss for the second quarter and gave a lighter-than-expected Q3 outlook

- SoFi Technologies surged after the personal finance company soared past Q2 expectations

- Uber fell 4% after Waymo announced a fleet partnership with Avis in Dallas

- UPS sank on mixed Q2 results and ongoing pressure from a US manufacturing slump and volatile trade policies

- PayPal fell despite posting better-than-expected Q2 results and hiking its outlook for the year

|

|

|

- Second-quarter GDP (first estimate)

- Earnings expected from Meta, Microsoft, Altria, Kraft Heinz, Humana, Etsy, Qualcomm, Arm Holdings, Lam Research, Carvana, Allstate, Ford, MGM, and Robinhood*

|

*Robinhood Markets Inc. is the parent company of Sherwood Media, an independently operated media company subject to certain legal and regulatory restrictions. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment